Traffic moves along Maple Street in Fayetteville near the construction site for the Sterling Frisco apartment complex.

Photo: Todd Gill, Fayetteville Flyer

The Northwest Arkansas apartment market continues on an upward path for both rental rates and occupancies.

Units are nearly full while rents continue to increase, according to a report by CB Richard Ellis, a commercial real estate brokerage firm.

“The dip in occupancy and rental rates caused by the ‘Great Recession’ has been erased,” said Brian Donahue, an apartment specialist with the CBRE Northwest Arkansas office in Fayetteville. “We expect sale transaction volume to exceed historic norms in the near term with an increasing number of new regional and national investors targeting tertiary markets like Northwest Arkansas.”

Overall apartment occupancy in mid-2013 averaged 96.5 percent, up from 94.5 percent in mid-2012.

Average rents are $588 per month, an increase of $22 from last year.

Move-in deals and discounted rates are nearly obsolete right now. Donahue said only 8 percent of properties surveyed were running some sort of rent special or concession – down from 12 percent six months and 16 percent a year ago.

Construction began last month at West Center, a planned five-story, 471-bed complex on the south side of Center Street between Duncan and Harmon avenues.

Todd Gill, Fayetteville Flyer

In other words, it’s a good time to own an apartment complex in Northwest Arkansas.

Market rate construction on hold

While vacancy rates are low, new construction has come to a relative halt outside of the student housing projects being built in Fayetteville.

The only market rate project (non-student complexes with more than 50 units) under construction in the area is Lindsey Management’s expansion of the Copperstone Apartments complex in Bentonville, which will add 96 units.

Donanue said developers may be waiting to see how the increase in student housing in Fayetteville affects the vacancy numbers before moving forward with new projects.

Soaring UA enrollment means more student housing

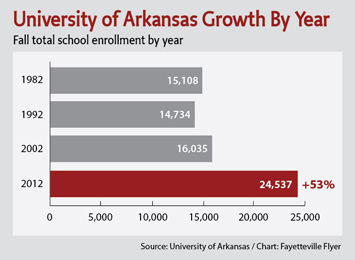

In 2009, the University of Arkansas’ total fall enrollment was just under 20,000. By 2012, the undergraduate population alone was larger than that at 20,350. After adding in 4,187 graduate and law students to the roster, the UA had recorded a 53 percent increase in enrollment in just a decade.

With the university anticipating more than 28,000 students by 2015, it’s no wonder Fayetteville is seeing a growth spurt in student housing.

Four rent-by-the-bedroom student complexes – The Domain, Sterling Frisco, The Vue and West Center – are all under construction in Fayetteville, and a fifth called Eco Downtown is in the final stages of planning. The Grove, a 232-unit, 632-bed complex opened last fall.

The Domain should be fully completed before the fall UA semester, while Sterling Frisco and The Vue will likely have at least some units ready for the start of classes. West Center began construction in June and is expected to be ready by 2014.

Once complete, the projects will have added 1,175 units with over 3,500 beds to a college town whose university’s enrollment has skyrocketed.

The findings of the survey suggest the increase in student apartments will have a noticeable impact on overall occupancy levels in the Fayetteville area.

However, Donahue said he expects the market will absorb the new units relatively quickly.

Further, he added, “As the demand for student housing is met, market rate construction should begin as we expect the basic fundamentals of this area in Arkansas to remain strong.”

Northwest Arkansas occupancy rates

Average rates as of mid-2013.

NWA as a whole: 96.5% occupied, up from 94.5% in mid-2012

Fayetteville: 95.5% occupied, up from 95% in mid-2012

Springdale: 96.5% occupied, up from 91% in mid-2012

Rogers: 98.5% occupied, up from 97% in mid-2012

Bentonville: 98% occupied, up from 96.5% in mid-2012

Northwest Arkansas apartment rents

Rogers and Bentonville carry the highest average rents for apartment complexes with 50 or more units.

| 1 bed/1 bath | 2 bed/1 bath | 2 bed/2 bath | 3 bed/2 bath | |

|---|---|---|---|---|

| Fayetteville | $470 | $531 | $680 | $877 |

| Springdale | $422 | $475 | $593 | $624 |

| Rogers | $560 | $508 | $861 | $1,093 |

| Bentonville | $546 | $601 | $742 | $749 |

Source: Northwest Arkansas Apartment Market Survey for mid-year 2013. CB Richard Ellis surveyed just over 22,000 of the area’s approximate 28,000 units. The survey does not include complexes with less than 50 units.