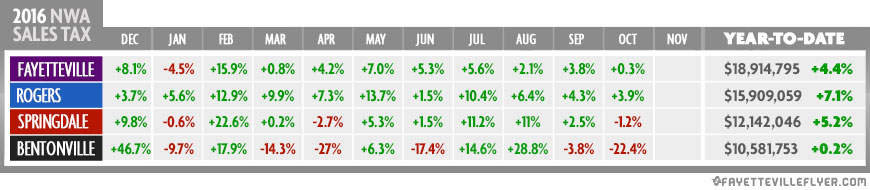

Sales tax receipts were up in two of the four major cities across Northwest Arkansas this month.

Fayetteville and Rogers were both up over October 2015 revenues, while Springdale and Bentonville each reported declines.

Fayetteville was at the top of the list for total revenues, collecting nearly $1.73 million in general fund tax dollars. Rogers collected $1.45 million, while Springdale collected about $1.14 million, and Bentonville collected $933,000.

Each city collects a 2 percent sales tax. One percent goes into a general fund. The other 1 percent goes toward repayment of bonds. The numbers reported by the Fayetteville Flyer represent the 1 percent going into general funds.

October sales tax revenue is collected in November and delivered in December.

Here are the specifics:

Fayetteville received $1,728,473 for a 0.3 percent increase over last year, a difference of $4,458.

Rogers collected $1,454,347, a $55,075 increase over last year when the city received $1,399,273.

Springdale received $1,136,670 for a 1.2 percent decrease over last year, a difference of $13,715.

Bentonville collected $933,009, a $268,490 decrease from last year when the city received $1,201,499.

2016 Totals

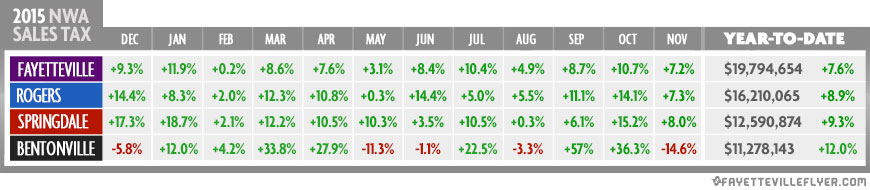

2015 Totals

Source: City of Fayetteville