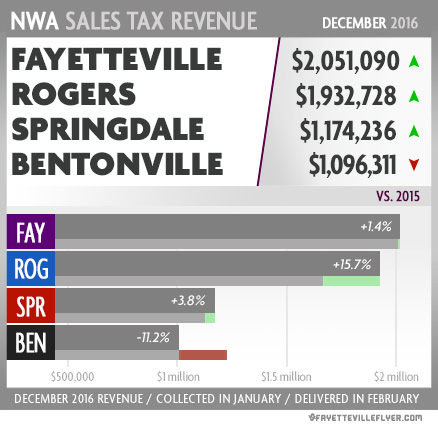

Sales tax receipts were up in three of the four major cities across Northwest Arkansas this month.

Fayetteville, Springdale and Rogers remained positive, while Bentonville showed a decrease of about 11 percent over December 2015 revenues.

Fayetteville was at the top of the list for total revenues, collecting $2 million in general fund tax dollars. Rogers collected $1.9 million, while Springdale collected about $1.2 million, and Bentonville collected nearly $1.1 million.

Each city collects a 2 percent sales tax. One percent goes into a general fund. The other 1 percent goes toward repayment of bonds. The numbers reported by the Fayetteville Flyer represent the 1 percent going into general funds.

December sales tax revenue is collected in January and delivered in February.

Here are the specifics:

Fayetteville received $2,051,090 for a 1.35 percent increase over last year, a difference of $27,352.

Rogers collected $1,932,728, a $261,496 increase over last year when the city received $1,671,232.

Springdale received $1,174,236 for a 3.76 percent increase over last year, a difference of $42,565.

Bentonville collected $1,096,311, a $137,905 decrease from last year when the city received $1,234,216.

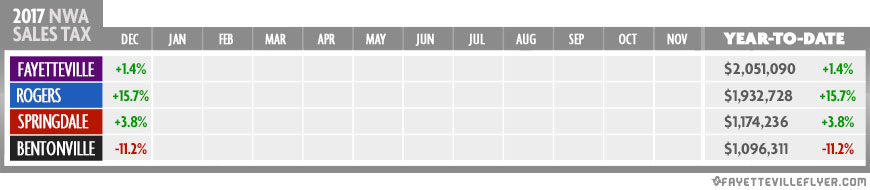

2017 Totals

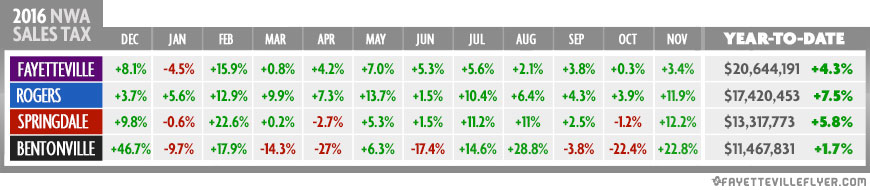

2016 Totals

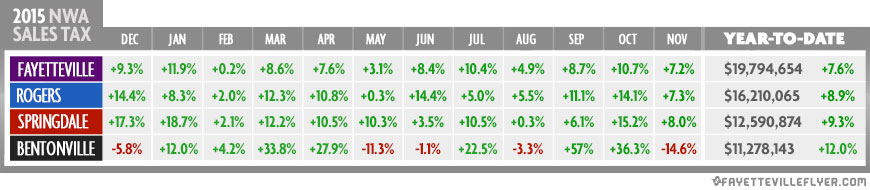

2015 Totals

Source: City of Fayetteville