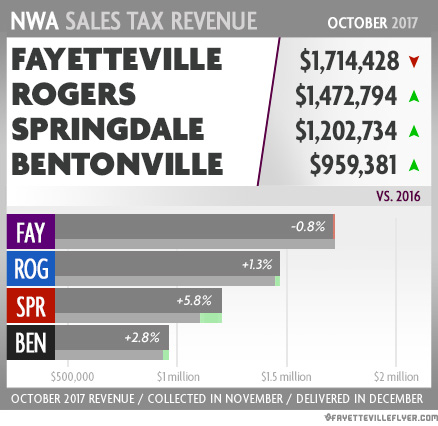

Sales tax receipts were up in three of the four major cities across Northwest Arkansas this month.

Springdale, Rogers and Bentonville each showed increases for October collections, while Fayetteville showed a slight decline over the same month last year.

Fayetteville, however, was at the top of the list for total revenues, collecting $1.7 million in general fund tax dollars. Rogers collected $1.4 million, while Springdale collected $1.2 million, and Bentonville collected about $960,000.

Each city collects a 2 percent sales tax. One percent goes into a general fund. The other 1 percent goes toward repayment of bonds. The numbers reported by the Fayetteville Flyer represent the 1 percent going into general funds.

October sales tax revenue is collected in November and delivered in late December.

Here are the specifics:

Fayetteville received $1,714,428 for a 0.8 percent decrease from last year, a difference of $14,045.

Rogers collected $1,472,794, a $18,447 increase over last year when the city received $1,454,347.

Springdale received $1,202,734 for a 5.8 percent increase from last year, a difference of $66,064.

Bentonville collected $959,381, a $26,372 increase from last year when the city received $933,009.

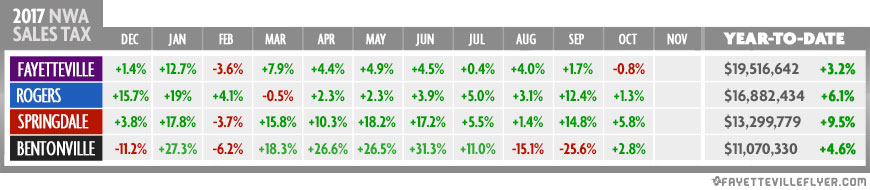

2017 Totals

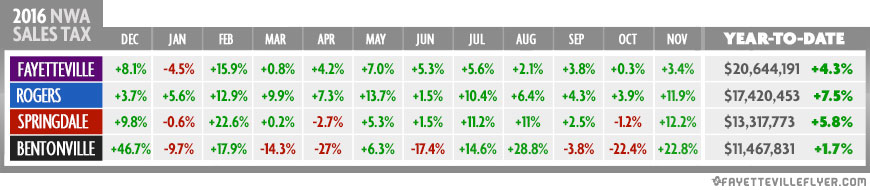

2016 Totals

2015 Totals

Source: City of Fayetteville